Table of Content

Regardless of what insurance coverage price matches your state of affairs, you can often get financial savings by comparison buying. For instance, Maserati and BMW are a few of the most expensive cars to insure, while older models similar to Hyundai venue and Honda CR-V are the cheapest to insure. States have slightly different minimal necessities for insurance coverage, so you’re going to have to make sure your insurance coverage plan meets those requirements. It’s useful to go looking on-line for car insurance coverage for 30 days in your state, not just within the US.

Many firms offer reductions for things like being a good driver, having a number of policies with the same company, or belonging to sure organizations. Finally, ensure you’re not paying for protection you don’t want. For example, in case you have an older automotive, you may not need collision or comprehensive protection. According to NerdWallet, the nationwide common for automobile insurance premiums is $1621 to $1758 yearly.

Common Automobile Insurance Charges By Company For Full Coverage

The common car insurance coverage policy costs about $1,200 per 12 months, or $100 per 30 days. But that is just a mean, and your rates could possibly be higher or decrease relying on a quantity of components. In this blog submit, we’ll check out a variety of the issues that affect your automotive insurance coverage charges, and how one can save money in your premiums. Insurers typically contemplate age as a major factor in setting auto insurance charges, with young drivers paying the best premiums on common primarily based on 2022 charges. Note that your age won't affect your premium when you live in Hawaii or Massachusetts, as state rules prohibit auto insurers from using age as a rating factor. Depending on your automobile insurance coverage company and the liability protection you choose, a 25-year-old may pay roughly than their state’s average automotive insurance price per 30 days.

Car insurance coverage charges after an accident enhance an average of 45% for drivers who cause property damage. That spikes the typical rate by $720 a yr, from $1,601 to $2,321. Car insurance coverage prices begin to lower as you move past your teenage years. As lengthy as you'll find a way to maintain your driving record away from accidents or tickets, your charges should become cheaper and stay there until you attain your 70s. State minimal car insurance is fairly low cost, however it supplies restricted safety. If your budget adjustments, you can increase your liability limits to get higher safety when you trigger an accident.

Compare Rates

All of our content is authored byhighly qualified professionalsand edited bysubject matter specialists, who ensure everything we publish is objective, accurate and reliable. Founded in 1976, Bankrate has a long monitor report of helping individuals make smart monetary selections. We’ve maintained this status for over four a long time by demystifying the monetary decision-making course of and giving folks confidence by which actions to take subsequent.

Older drivers have higher crash deaths than drivers between the ages of 35 and fifty four, according to the Centers for Disease Control and Prevention. CDC data also reveals that 20 older adults are killed daily in car crashes. The quantity you’ll pay for automobile insurance coverage coverage will vary relying on the coverage required, the vehicle’s make and mannequin, your driving history and the state you reside in. If you qualify as a low-mileage driver, you typically pay decrease charges. If you drive 12,000 miles a 12 months, or less, your insurance company will sometimes consider that to be decrease than average, and you’ll probably pay a lower price than those who drive greater than that.

To Get Monthly Automobile Insurance Coverage Cover, You Have To

We used knowledge from Quadrant Information Services, a supplier of insurance data and analytics. Rates are primarily based on a driver with a clean document insuring a Toyota RAV4. The fee also includes collision and comprehensive with a $500 deductible. Minimum car insurance coverage charges embrace the minimum quantity of auto insurance coverage required in each state.

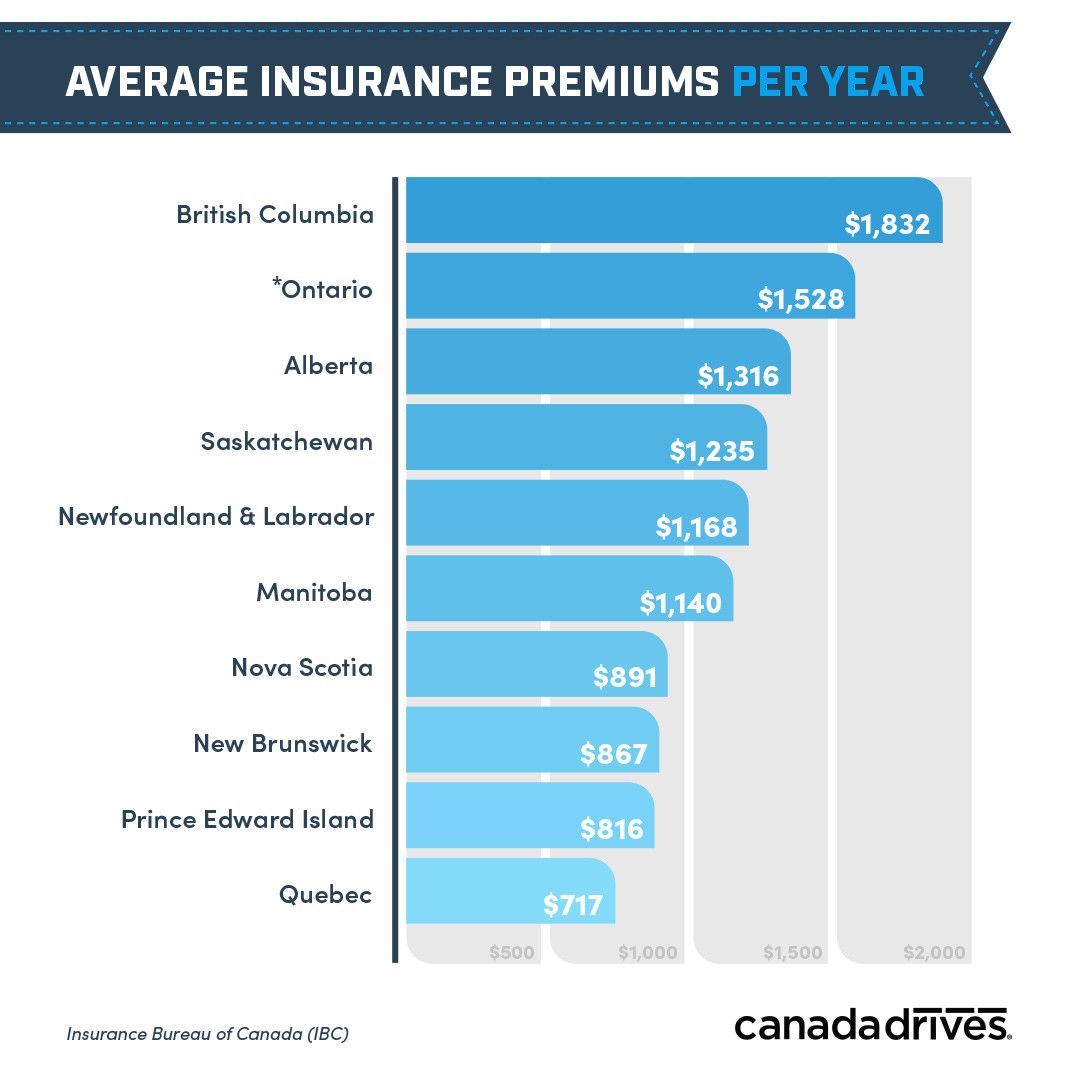

And while value is important, it’s additionally worth considering different elements like customer service and protection choices when selecting an insurer. Sports and luxury cars are some of the costliest autos to insure as a end result of they arrive with greater restore prices. Drivers also have a tendency to engage in dashing and different risky driving behaviors greater than folks with slower automobiles. On the opposite hand, regular-sized pickup vehicles, affordable SUVs, and sedans with good security ratings are inclined to have some of the lowest common car insurance coverage. The quantity you pay for minimum insurance coverage is dependent upon a wide selection of elements, however one of the most necessary is the state you live in. Check beneath to see average minimum automotive insurance coverage rates by state.

How Much Is The Average Car Insurance Coverage Per 30 Days In My State?

First, you want to decide if you’re paying monthly, yearly, or semi-annually. Monthly automobile insurance policy combine flexibility with affordability. You can defend your automobile and not utilizing a 6-month or 12-month commitment. For practically 20 years, she has been serving to consumers learn how insurance coverage legal guidelines, knowledge, trends and coverages affect them. She enjoys translating the complexities of insurance into easy-to-understand advice and ideas to assist customers make the most effective decisions for their needs.

However, folks are generally surprised to search out that insurance corporations may consider when determining insurance premiums. Drivers under 25 have less expertise on the highway and research present they trigger extra accidents.three So, should you or someone on your coverage is underneath 25 years old, your automotive insurance coverage premiums could also be higher. Auto insurance rates could decrease after a driver turns 25, particularly if they haven’t had any at-fault accidents.

Common Automotive Insurance Coverage Cost By Protection Sort

We do not provide monetary advice, advisory or brokerage companies, nor do we advocate or advise individuals or to purchase or sell explicit shares or securities. Performance information may have changed because the time of publication. Our mission is that will assist you make educated insurance coverage selections with confidence. We have an promoting relationship with some of the offers included on this page.

At a glance, USAA is the least pricey, although it's obtainable solely to veterans and their families, while Liberty Mutual is the costliest. Having a extreme infraction like a DUI on your motorcar report may enhance your car insurance premium by 93% on average. Check your insurance policy’s cancellation coverage to discover out how simple it is to change. You might already be successfully paying for monthly automobile insurance without knowing it. If you live in an area with excessive charges of automobile accidents or theft, you’ll probably pay more for auto insurance coverage. Cheap automotive insurance coverage in Louisiana, but they’ll likely pay lower rates than single drivers with related profiles.

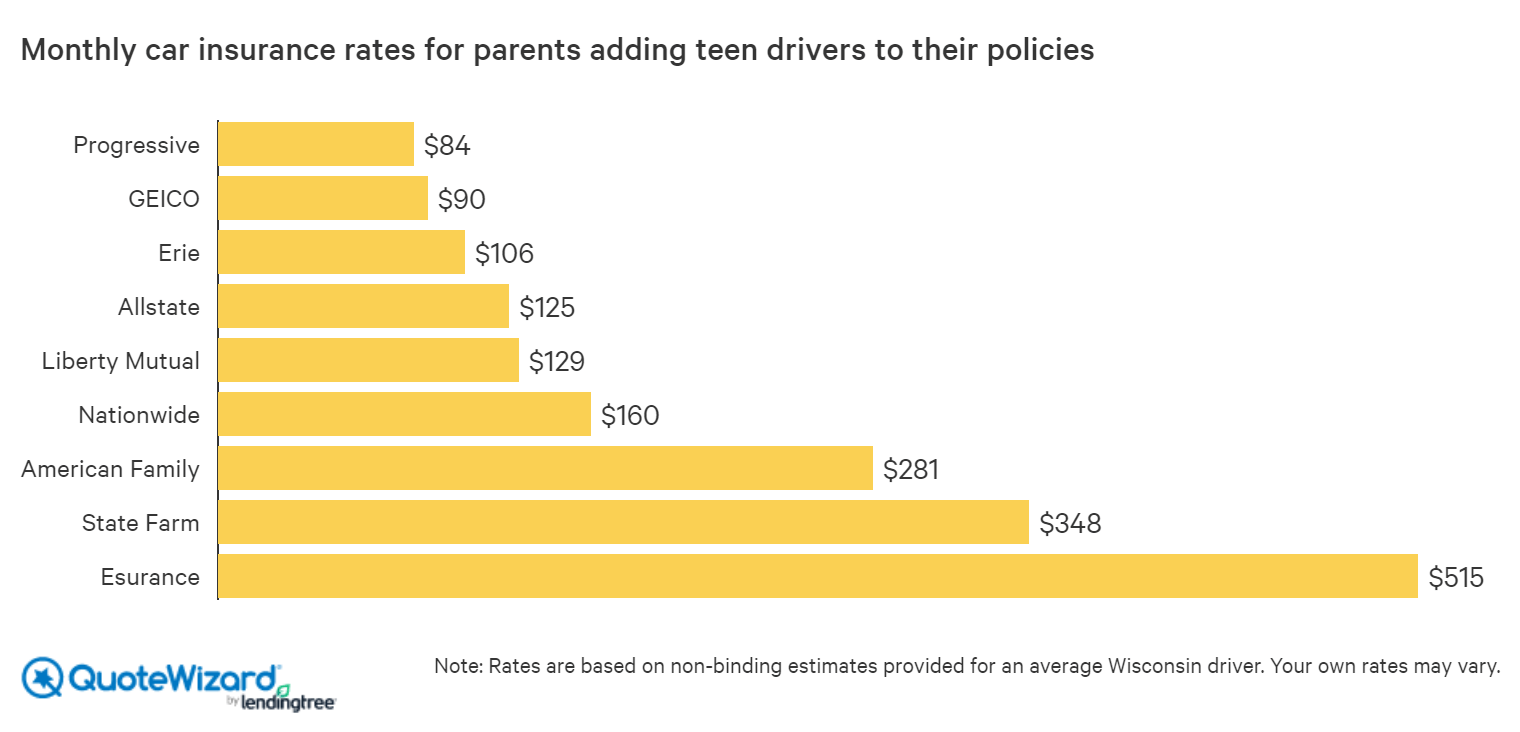

Teen drivers are inexperienced and get into extra accidents than older drivers, which suggests teen drivers are super costly to insure. That makes it critical to shop for the most effective low cost car insurance coverage for teen drivers. Each auto insurance company assesses threat in a special way which implies prices can vary significantly amongst firms. That’s why comparing auto insurance coverage quotes with multiple firms might help you find the most effective worth in your specific situation. The common cost of automotive insurance in Ohio is $1,023 per yr whereas the typical annual cost in Florida is $2,560 per yr for a full-coverage policy in 2022. In an accident, drivers with only basic protection might face more out-of-pocket bills.

If you get a DUI, shopping for insurance is integral to discovering inexpensive insurance. While DUI insurance charges will all the time be higher than the common value of insurance coverage, some companies are slightly more forgiving than others. Four states have reduced insurance coverage companies’ capability to use your credit score to resume your policy or enhance your rates, including Maryland, Michigan, Oregon, and Utah.

No comments:

Post a Comment